How to Process a Bonus Payroll

Bonuses can be included with your regularly scheduled payroll submission, or you can submit a separate payroll to pay your employees’ their bonuses.

To add a bonus to an employee’s check, follow the below steps:

-

"Start Payroll" as normal

-

While in the "Enter Payroll" screen, select the blue plus box under the earnings column

-

Choose from either an existing earning or create one if needed

-

Add a description if desired

-

Enter the amount

-

Click the blue "Add Earning" button

-

Complete payroll as normal

OR

-

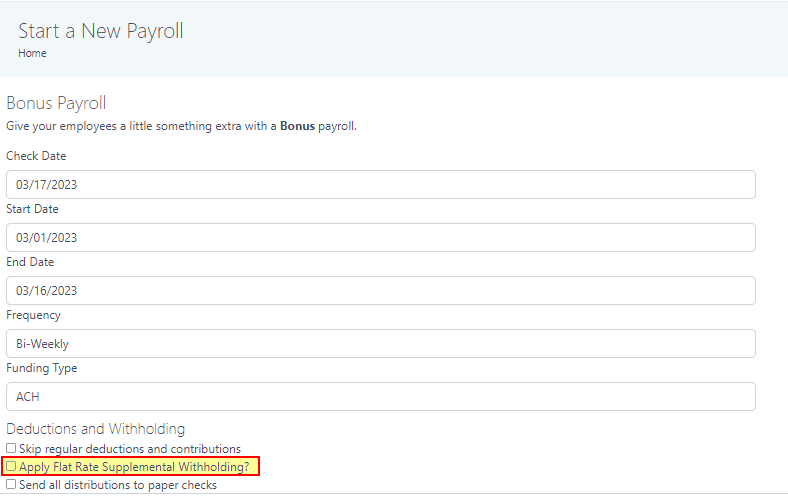

Click "Start Payroll" in the Quick Actions Section on the Company Dashboard

-

Select “Start Now” under “Bonus”

-

Enter your desired check date, pay period dates, frequency, and any changes you’d like to make to regular deductions and withholdings

-

“Continue” in the bottom right corner

-

Select the employees you would like to give a bonus to

-

“Add employees”

-

Enter the Bonus amounts

-

"Save and Preview" in the bottom right corner

-

Review your payroll and make changes as needed

-

Submit!

OR

If you’d like your employees to receive a flat net amount of your choice:

-

Choose "Start Payroll" in the Quick Actions Section on the Company Dashboard

-

Select “Start Now” under “Bonus”

-

Enter your desired check date, pay period dates, frequency, and any changes you’d like to make to regular deductions and withholdings

-

“Continue” in the bottom right corner

-

Select the employee you would like to give a bonus to

-

Choose “Add Net-to-Gross Check” to the right of each employee

-

Enter the net amount you’d like the employee to receive and a description if desired

-

Click “Add”

-

Repeat for each employee you are giving a bonus to

-

“Cancel”

-

"Save and Preview" in the bottom right corner

-

Review your payroll and make changes as needed

-

Submit!

Note, you can add the flat rate supplemental wage withholding percentage using Bonus payroll processing type.